Climate change isn’t just a future problem or a distant concern. It’s already influencing the prices we pay for food, energy, insurance, and more. This hidden cost is called climate inflation, and it’s something we all need to understand — especially as the current working population plans for their retirement during the years between 2040 and 2060.

In this post, we’ll break down what climate inflation is, why it matters, and how you can prepare for it in your everyday life.

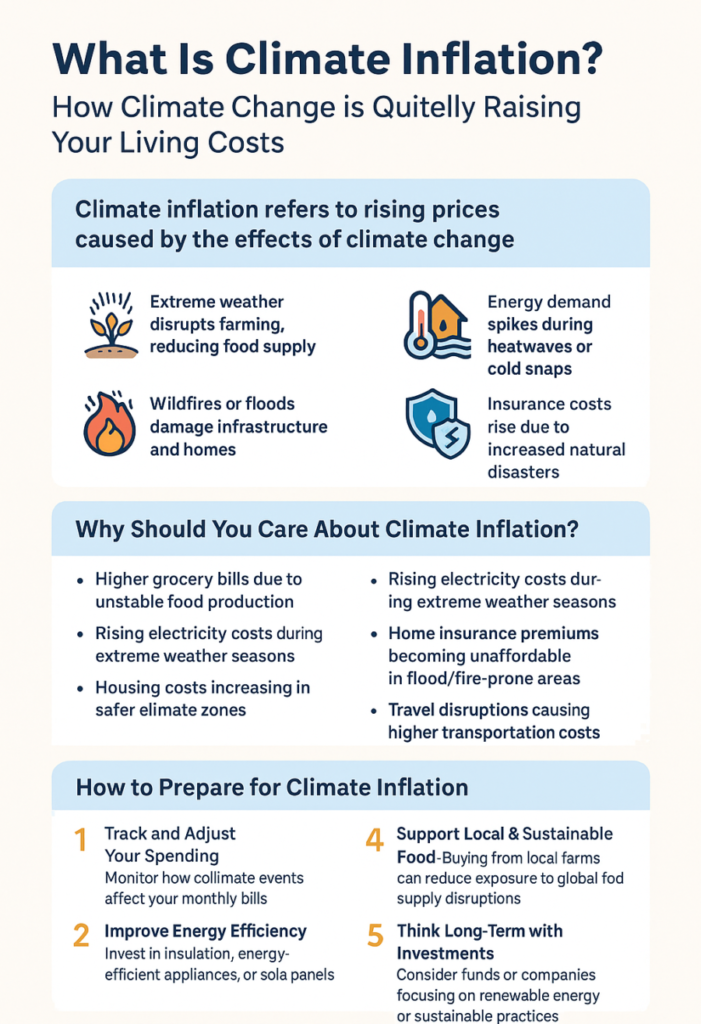

What Is Climate Inflation?

Climate inflation refers to rising prices caused by the effects of climate change. It’s not the same as regular inflation, which is tied to interest rates, wages, or economic policies. Instead, climate inflation happens when:

- Extreme weather disrupts farming, reducing food supply

- Wildfires or floods damage infrastructure and homes

- Energy demand spikes during heatwaves or cold snaps

- Insurance costs rise due to increased natural disasters

Example: If a drought damages wheat crops in key farming regions, bread and pasta prices can rise globally – even if your local economy is stable.

Why Should You Care About Climate Inflation?

You may already be feeling the effects without realizing it. Between now and 2060, experts predict climate-driven price increases will become more frequent and severe. Here’s how it could affect your life:

- Higher grocery bills due to unstable food production

- Rising electricity costs during extreme weather seasons

- Home insurance premiums becoming unaffordable in flood/fire-prone areas

- Housing costs increasing in safer climate zones

- Travel disruptions causing higher transportation costs

Even if climate disasters don’t hit your area directly, the economic ripple effect will still impact your wallet.

How to Prepare for Climate Inflation

You can’t control the weather, but you can make smart decisions to build financial and personal resilience:

1. Track and Adjust Your Spending

Monitor how climate events affect your monthly bills — especially utilities and groceries.

2. Improve Energy Efficiency

Invest in insulation, energy-efficient appliances, or solar panels to reduce heating and cooling costs long-term.

3. Plan Insurance Strategically

Review your home and health insurance plans. Consider coverage in case of climate-related events.

4. Support Local & Sustainable Food

Buying from local farms can reduce your exposure to global food supply disruptions.

5. Think Long-Term with Investments

Consider funds or companies investing in renewable energy, climate resilience, or sustainable practices.

Final Thoughts

Climate inflation isn’t just an environmental issue – it’s a financial one. As we move closer to 2040–2060, the economic impact of climate change will likely affect every household.

Being proactive today can save you money — and stress — tomorrow.

Stay informed. Stay prepared. And start small – every action counts.

PS: Here is an article I wrote on 101 Climate Change Impacts You Should Know.